[#6] Platform Business Models - Part 1

Software eating the world is a mere manifestation of businesses wanting to become platforms

Welcome to a new edition of Bizit, by Pratyush and Aditya. It’s just been a week since we’ve launched and the community has already grown to an overwhelming 110 people. You could pass on the love to by sharing this with interested friends, colleagues, and family. Thank you for subscribing!

About this week

In our last story, we analyzed platforms, their types, and also saw the platform approach taken by Indian startups. It also helped us learn two very important things from the readers -

“While my interest in platforms is unabated, not everybody tends to think of platforms the way you do.”

“Some of your content is difficult to comprehend. It’d be great if you could provide some sort of structure to it.”

We hear you. It’s the 21st century and the importance of platforms cannot be overstated. Everything from IoT, Artificial Intelligence/Machine Learning, 3D printing, Robotics, Software eating the World are all mere manifestations of larger macro-trends happening around in the world today. And we can expect all of this to be substituted with even more kinds of manifestations in the future, all part of the macro-trend.

Thus, moving forward it’s imperative for us to be able to understand what platforms are in a structured way that can be applied across industries and use-cases. Thankfully, it’s something we are very interested in and have enough ideas to write a book on, some time. :P

But let’s stick to the newsletter for now, start with an interesting excerpt published in Techcrunch by Tom Goodwin and jump right in.

But first things first, if you’re reading this newsletter for the first time, please take a moment and consider signing up.

Back To The Future

Credits: This idea has been borrowed from this talk by Sangeet Paul Chaudary

If you’d watched this movie in the 90s, you’d be hoping for flying cars in the 21st century. But here you’re stuck with newsletters. Yet, we think that a future with 280 character Tweets & 1300 character LinkedIn posts is probably a lot more valuable than one with flying cars.

“We’d hoped for flying cars, instead we got 140 characters” - Peter Thiel

Internet was available to the masses in the 90s but the shifts mentioned in the Techcrunch excerpt took 20+ years to manifest. And it’s with good reason.

In the 90s and 2000s, the internet was something that was accessed on a personal computer. We had to sit on a desk to access the information the internet was pouring on us. That was largely changed on 29th June 2007, thanks to a visionary.

With smartphones, the internet has become ambient. The lines between being online and offline are blurring every day. As we move closer to wearables, there won’t be any more distinction between physical and digital. Connectivity (whether you’re connected or not) would be the only distinction that’d remain and that’s why you see every major technology company splurging billions to get people to come online.

This is what we call the Industrial Revolution 4.0. This will be an era where an expensive computer disconnected to the internet is a lot less digital than a connected truck. This is also an era where an average smartphone has 28 sensors.

1+3 Reasons Why It Matters

Industrial Revolution 4.0, broadly, has 4 major enablers -

Democratization of access: Because of smartphones, wearable devices, and sensors, the world is coming to the internet. Everyone and everything is on the internet all the time. Every physical good can have a digital presence/replica - from industrial machines to the sleep patterns of humans. This creates massive troves of data (and data is the new oil) and hence, anything that is connected to the internet is far more valuable.

Democratization of production: If you’re a nerd like me, you’d remember this famous pitch by Steve Jobs while launching the iPhone. It sure did democratize the access to the internet from PC into a mobile phone. But it also gave the ability to the users to become producers. With cameras, everyone can be a photographer and that led to the evolution of Instagram. Similarly, with new-age tech like 3D printing, everyone can soon become a manufacturing plant should they choose to.

Democratization of intelligence: We might not have flying cars (yet) but we do have devices on our wrists that can measure our heartbeat. What it also does is it constantly captures data about its environment/user and becomes smarter. And once it builds some intelligence on the user, it learns from every other user who uses the watch. Meaning, the more it gets used the better it gets for other users. Smart, connected watches are learning from a community of watches.

Democratization of computing: Thanks to the cloud, everything in the world can become a computer provided it’s connected to the internet. Put in simple words, it helps collect large troves of data, process them quickly, and use it to infuse intelligence every connected entity.

Business Models

Pipelines: Traditional Business Models

Traditionally businesses were/have been designed to function as pipelines or value chain business models. Businesses create products/services, push them out through an owned distribution, and sell them to customers. Value is produced upstream and consumed downstream. There is a linear flow, much like water flowing through a pipe.

Pipes are omnipresent. All of manufacturing is done on pipelines. Television is a pipe as well, spewing out content at us. In fact, the education system is also a pipe where teachers push their knowledge out to the students.

Credits: The design has been inspired by the work of The Platform Institute

The pipeline model is also present on the internet. Selling games to us through CDs is a pipeline model and so is reading this newsletter.

How do pipeline businesses scale?

They scale in 2 ways:

They can improve operating margins by making it easier for a larger amount of value to flow more efficiently from the consumer. This is typically the case of operational efficiency.

Also, a pipeline could convince a larger number of customers to pay a larger amount of currency in exchange for the value. In this case, the business scales through marketing.

Platforms: Modern Business Models

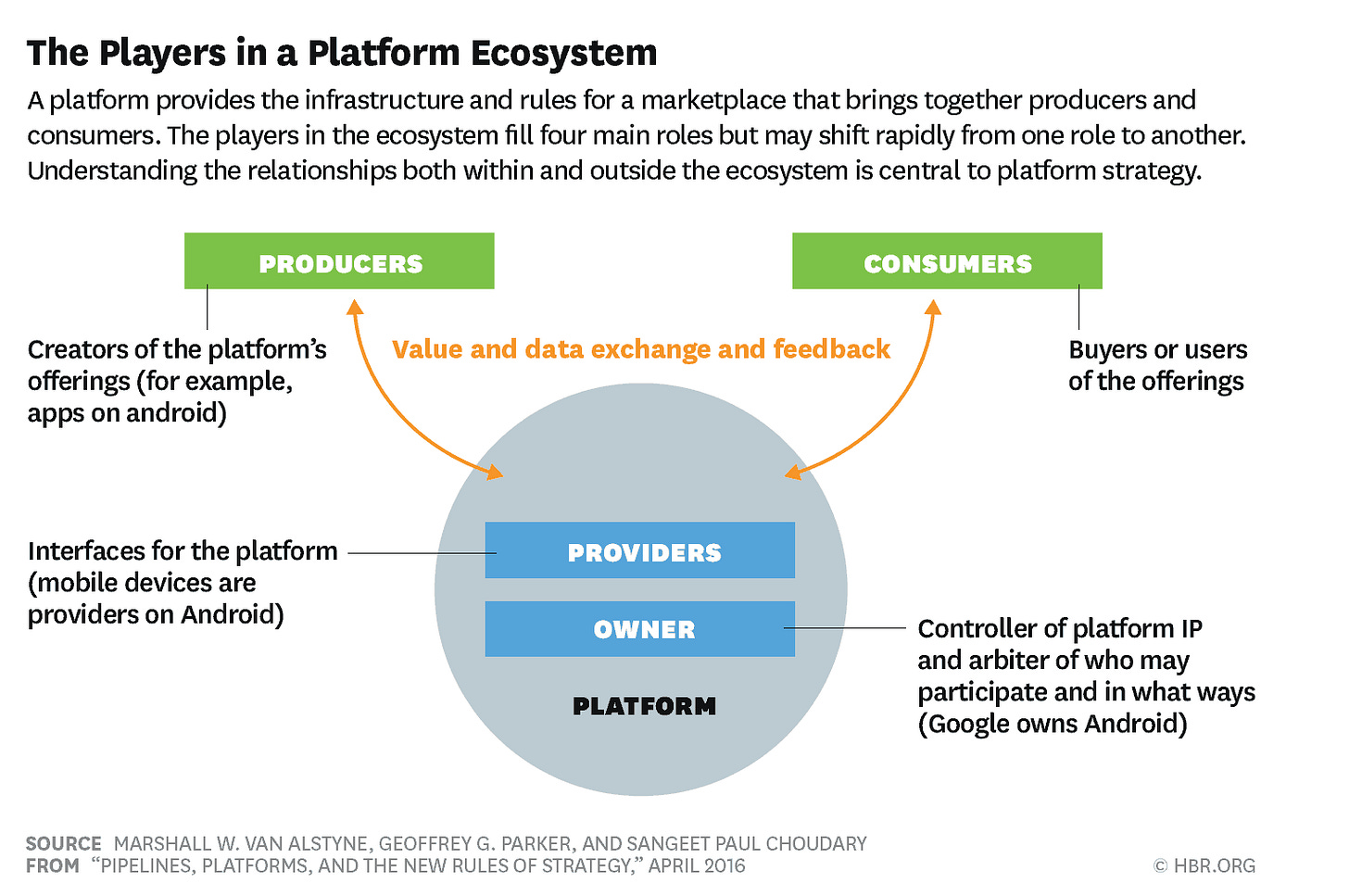

In a platform business model, multiple participants (producers & consumers) to connect to the platform, interact with each other, and create and exchange value. Put in other words, platforms connect different entities (producers, participants & consumers) with each other and facilitate interactions b/w them. These interactions create value on the platform for the participants. Interactions could range from financial transactions (Visa/Mastercard) and social interactions (Facebook/Snapchat) to e-commerce orders (Amazon).

Credits: The design has been inspired by the work of The Platform Institute

Well, using modern here is inaccurate as platforms have existed for years. Malls are platforms that connect buyers and sellers. Newspapers are platforms that connect subscribers and advertisers. But what’s changed and as we’ve learned in the previous section is that the democratization of access, production, intelligence, and computing, has largely reduced the need to own any physical assets or infrastructure.

It’s important to understand that in a platform, the value is not created by the firm but it’s created by the interactions.

Technology makes building and scaling up platforms vastly simpler/cheaper, as it enables and facilitates efficient interactions that strengthen network effects, and enhances the ability to capture, analyze, and exchange huge amounts of data that increase the platform’s value to all.

The Lure of Platforms for Pipelines

Platforms come in many varieties, platforms tend to create ecosystems with a similar structure. There are the platform owners who control the kind of interactions that happen on the platform. Then there are providers of the platform who act as the interface b/w the platform and its users. Producers are the ones who act as the supply on the platform and consumers are those who fill in as the demand.

Due to the presence of so many different stakeholders and their design, platforms are an inherent threat to any business. (Aditya will provide a microeconomics angle in the next post). The difference lies in how the value is created in these different models.

The industrial economy always functioned on the basis of supply-side economies at scale. They start with massive upfront fixed costs but low marginal costs meaning that firms achieving higher sales volume than their competitors have a lower average cost of doing business. This allows them to reduce prices and increase volumes further. This gave us firms like General Electric, Ford Motors, and Standard Oil.

In such economies, firms achieve market power by controlling resources, processes, and iterating to keep making them more efficient, and fending off challenges from any one of Porter’s 5 forces.

In an internet-enabled economy, the driving force, however, is demand-side economies of scale, also called network effects. These are enhanced by the rapid improvements in technology that help you create app ecosystems, social networks, demand aggregation, and other phenomena that help amplify the network effects. Thus, the firms that achieve a higher volume of participants (i.e. attract more platform participants, both producers, and consumers) than the competitors and facilitates more interactions b/w the participants have a higher value per transaction.

This is because, the larger the network, the better the matches b/w supply and demand and the better quality of interactions on the platform and richer the data that is fed into the ecosystem as feedback. This increases the overall value of the platform. Greater scale attracts even more participants that in turn creating even more value - a virtuous feedback loop that, theoretically at least, produces monopolies.

This is the reason why executives of every major business, from GE to Walmart, are scrambling to incorporate platforms into their models. And this is also why when a platform business enters an area dominated by pipelines, the platform almost always wins.

Shifting from Pipelines to Platforms

With all the frameworks now in place, let’s explore how pipelines can become platforms. The movement is characterized by three key shifts:

Shift in markets - from consumers to producers: In a pipeline business model, there's a clear demarkation b/w producers and consumers. But users of the platforms (i.e. participants) take the roles of both producers and consumers. Content creators on YouTube and drivers on Uber are producers on the platform who create value on it. Thus, a competitive moat of a platform is the value its members/participants own and contribute - from rooms and cars to ideas and content. The network of producers and consumers is the biggest asset/moat.

Shift in competitive advantage - from resources to ecosystems: Pipelines compete on the basis of control and ownership of internal resources, processes, and IPs. While platforms compete based on the strength of their ecosystem and the resources in it. The participants in the platform bring these resources and IPs to the ecosystem to create more value for the platform.

Shift in value creation - from processes to interactions: As we’ve already elucidated, in a pipeline model, value creation is centered around an end-to-end process that shifts value to the users from the producers. These processes organize internal labor & internal resources. In platforms, value is created and exchanged in the interactions between producers and consumers. These interactions match and coordinate the different resources users bring into the ecosystem.

All these points are discussed in detail in The Platform Revolution Book and The Platform Institute provides a great framework for the same.

To summarize, a shift from pipelines to platforms changes how firms/businesses -

Create value

Interact with markets

Build and sustain a competitive advantage

Eventually, the shift from a pipeline model to a platform model changes the way a business creates and scales value.

With this, we’ve come to the end of the first part. There’s a lot more we’ll be discussing in the subsequent posts. Stay tuned. :)

Meanwhile, we’d love to know if you agree/disagree and why. Let us know what you think in the comments.

We’ve covered 6 topics so far. Why don’t you take a look at them here? We’re sure you’d like them.

We’re constantly listening to you for suggestions and feedback to improve. We’ve also added a section for you to recommend a good podcast/article/post/Tweet(s)/video to the community. If you want us to acknowledge you, drop in your name/link to your LinkedIn/Twitter profile in the space as well.

So, it’d be great if you let us know how you like our newsletter so far.

In case we haven’t met, I’m Pratyush Choudhury. A huge shout out to Priyanshi Porwal for helping us with the illustrations.

Thank you for reading. We hope it was worth the while and left you better than it found you! :)

——

And if you enjoyed reading this, please share further.

The bigger authority in terms of the next industrial revolution is Jeremy Rifkin with his books The Third Industrial Revolution, Zero Marginal Cost, etc.

His talks at Google & his live audience session that he did for Vice are mind-blowing.